Contents:

It’s not enough to save money for retirement; you need to invest to make that money grow. To become a professional, modern investor, it is necessary to constantly update your knowledge and skills, as well as improve your educational level. Whether you’re just starting to invest or you’re a seasoned pro, Gainy is the perfect investment tool for you. Investing in themes you believe in is a good way to stay invested. If you believe in something long-term, you’re more likely to keep it for the long term. If you’re a beginner to investing, there are some things to think about before you jump in.

When done correctly, investing can provide a much-needed financial cushion. When it comes to investing, there are a number of different strategies that can be employed in order to achieve success. Any experienced investor will tell you that one of the most important aspects of successful investing is remaining calm in the face of market volatility. You can start with as little as 1% of each paycheck, though it’s a good idea to aim for contributing at least as much as your employer match.

/R E P E A T — Media Advisory – Government of Canada to announce major investment in world-leading insti – Benzinga

/R E P E A T — Media Advisory – Government of Canada to announce major investment in world-leading insti.

Posted: Fri, 28 Apr 2023 11:34:00 GMT [source]

The benefit of compound earnings is that any profit you earn is reinvested to earn additional returns. It increases your chances of being able to afford the same amount of goods and services in the future that you can today. Be sure to take advantage of the wealth of courses, articles, and other materials that you can find right here on our website. We will, of course, be publishing additional material that will delve more deeply into subjects such as technical analysis and equity valuation.

Make sure you understand what is motivating you to invest. Investing can give your money the best chance of growing in the long term. This is particularly true when thecost of living is risingas rapidly as it is now. There also isn’t one magic formula to investing, but there are some sensible strategies you can consider adopting. Receive a selection of our best stories daily based on your reading preferences. Once an aspiring investor has analyzed a few deals and is comfortable with their parameters and calculations, Rivers said it’s important to just bite the bullet.

How To Invest Money Based On Advice From Warren Buffett

Also, as a beginning day trader, you may be prone to emotional and psychological biases that affect your trading—for instance, when your own capital is involved and you’re losing money on a trade. Experienced, skilled professional traders with deep pockets are usually able to surmount these challenges. A strategy doesn’t need to succeed all the time to be profitable. Many successful traders may only make profits on 50% to 60% of their trades.

Times Money Mentor has been created in conjunction by The Times and The Sunday Times with the aim of empowering our readers to make better financial decisions for themselves. We do this by giving you tools and information you need to understand the options available. We do not make, nor do we seek to make, any personal recommendations on any matter.

Star Wars Jedi: Survivor – 10 Tips & Tricks For Beginners – DualShockers

Star Wars Jedi: Survivor – 10 Tips & Tricks For Beginners.

Posted: Fri, 28 Apr 2023 13:45:00 GMT [source]

The exit criteria must be specific enough to be repeatable and testable. Together, they can give you a sense of orders executed in real time. Day traders must be diligent, focused, objective, and unemotional in their work. Full BioSuzanne is a content marketer, writer, and fact-checker.

A good way to invest in commercial property is buying an investment trust where a manager selects a number of properties to invest in. While most people think of residential property investment, you can also invest in commercial property like warehouses and shopping centres. If you want to know more, find out how to choose investment funds here. Generally speaking, bonds are considered lower-risk than shares. You will be paid a set amount at the end of the period when the bond “matures”, as well as regular interest payments known as coupons. If you’re looking for a low-cost investment platform with good customer service, here are the top providers.

Automate Your Savings

Take advantage of any opportunity possible to learn before you open any investment accounts. You will understand more about the stock market and the investment strategy you want to employ. Rarely is short-term noise relevant to how a well-chosen company performs over the long term. It’s how investors react to the noise that really matters. Here’s where that rational voice from calmer times — your investing journal — can serve as a guide to sticking it out during the inevitable ups and downs that come with investing in stocks. Is what you do with the money you’re going to use to pay for short-term goals — ones in the next five years or so.

However, a decline in shares means that you will lose a good amount of money on your initial investment in addition to the cost of interest payable to the broker. Your investment portfolio will grow based on factors such as the amount of capital invested, the tenure of the investment and the net annual earnings on the capital. It is advised that you begin investing as early as possible as it can help you save a significant amount of money.

Comprehensive Trading & Investing eBook

Usually, you’ll find the earnings of a company, the projected future stock price, and more in prospectuses. These types of funds are readily available in most 401 and other workplace retirement accounts. Some cost more than others, and the investment strategies vary from one fund family to the next. As a result, it’s important to check the expense ratio of the fund before investing. It’s a simple asset allocation plan consisting of just three asset classes, U.S. stocks, foreign stocks, and U.S. bonds.

- Investing is the act of committing money or capital to an endeavor with the expectation of obtaining additional income or profit.

- For beginners, though, it may be better to read the market without making any moves for the first 15 to 20 minutes.

- This can be difficult to do, as emotion often comes into play.

This is a measure of the number of times a stock is bought and sold in a given time period. It’s commonly known as the average daily trading volume. A high degree of volume indicates a lot of interest in a stock. An increase in a stock’s volume is often a harbinger of a price jump, either up or down.

Is Technical Analysis or Fundamental Analysis More Appropriate for Day Trading?

First, know that you’re going up against professionals whose careers revolve around trading. These people have access to the best technology and connections in the industry. If you jump on the bandwagon, it usually means more profits for them. You’re probably looking for deals and low prices but stay away from penny stocks.

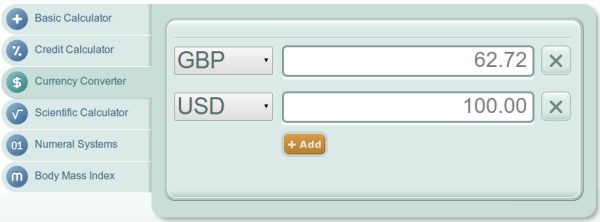

The desirability of health insurance claim settlement strategy of as an investment vehicle is reflected by the explosion of ETFs created by major brokerage firms such as Vanguard and Fidelity Investments. The amount of funds committed to ETFs grew by half a trillion dollars in 2016 alone. Even forex currency pairs can be accessed with ETFs, as can other alternative investments such as hedge funds or private equity investments.

Figuring in $50 monthly contributions, in 10 years, your investment account will have grown to $27,300 – almost double the account size that you’d have had withoutmaking any additional contributions. To learn more about investing in bonds, you can access helpful educational resources at Bankrate.com. Some bonds are issued as “zero-coupon bonds.” Rather than offering regular interest payments, zero-coupon bonds are instead sold at a significant discount from the bond’s face value. Investors make a return by purchasing the bond for less than face value and then redeeming the bond at maturity for full face value.

Investing 101: A Guide to Investing Basics

If you make smart decisions and invest in the right places, you can reduce the risk factor, increase the reward factor, and generate meaningful returns. Here are a few questions to consider as you get started. However, your percentages can be off after buying shares, after price fluctuations, and after dividend and capital gain reinvestments. If you are looking for excitement, then gambling at the casino might be a better option for you.

One other issue that ought to type a part of your goal is the taxpenaltiesof your investments. Like, investing in saving bonds ends in tax saving whereas; earnings from the inventory market are liable to tax. At all times contemplate components like funding interval, your tax bracket, the funding product, and so forth. In case your risk tolerance is low, keep away from funding within the devices carrying an excessive chance of incurring losses.

Investment Tips For Beginners

Like dollar-https://1investing.in/ averaging, “buying in thirds” helps you avoid the morale-crushing experience of bumpy results right out of the gate. Divide the amount you want to invest by three and then, as the name implies, pick three separate points to buy shares. These can be at regular intervals (e.g., monthly or quarterly) or based on performance or company events. For example, you might buy shares before a product is released and put the next third of your money into play if it’s a hit — or divert the remaining money elsewhere if it’s not. NerdWallet’s ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

Whitney Tilson Touts A Stock ‘Pretty Close’ To Berkshire: ‘Will Continue To Be A Long-Term Winner’ – Micr – Benzinga

Whitney Tilson Touts A Stock ‘Pretty Close’ To Berkshire: ‘Will Continue To Be A Long-Term Winner’ – Micr.

Posted: Sat, 29 Apr 2023 18:38:32 GMT [source]

Checking in on your stocks once per quarter — such as when you receive quarterly reports — is plenty. But it’s hard not to keep a constant eye on the scoreboard. This can lead to overreacting to short-term events, focusing on share price instead of company value, and feeling like you need to do something when no action is warranted.

Bear in mind that there’s a lot that you can and should learn about investing in stocks to achieve financial success. However, right now, read on for the steps to begin the process. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

- For example, one stock investing strategy is the3 Fund Portfoliomade famous by The Bogleheads .

- As a day trader, you need to learn to keep greed, hope, and fear at bay.

- If you want an algorithm to make investment decisions for you, including for tax-loss harvesting and rebalancing, a robo-advisor may be for you.

- Making money consistently from day trading requires a combination of many skills and attributes—knowledge, experience, discipline, mental fortitude, and trading acumen.

- If you believe in something long-term, you’re more likely to keep it for the long term.

- In other words, you will look to buy fewer shares when prices are high and more when they are low.

Someone at or near retirement, however, is much more vulnerable to changes in the market. Now that you understand how investing works, it’s time to think about where you want to put your money. As a rule of thumb, remember that the best risk an investor can take is a calculated one. Stocks, on the other hand, are small pieces of equity in a company. When a company goes from private to public, its stock can be publicly bought and sold on the market — meaning it is no longer privately owned. A stock price is generally reflective of the value of the company, but the actual price is determined by what market participants are willing to pay or accept on any given day.